The dollar blue Argentina is the informal name given to U.S. dollar banknotes that circulate at a much higher exchange rate than the official Argentine peso. The blue dollar began in 2002 as a way to help Argentines circumvent the exchange controls established by the government. Today, it is an important part of the Argentine economy, used by everyone from large companies to ordinary people.

The main issues one should be concerned about as a traveler are: how to exchange currency when arriving in Argentina, what is the best way to do it, when to do it and where to do it.

All this I will try to explain in this long article and at the end you will have my conclusions and recommendations if you travel to Argentina from abroad.

Table of Contents

How did the dollar blue start?

The blue dollar began in 2002 as a way to help Argentines circumvent the exchange controls established by the government. At that time, the Argentine peso was pegged to the U.S. dollar at a rate of 1 to 1.

However, due to a variety of factors, including corruption and government mismanagement, the economy began to collapse and the peso began to lose value. To protect their savings, Argentines began to turn to U.S. dollars as a store of value. This created a demand for dollars, which led to a black market for dollars (known as the “blue market”). The blue dollar got its name from this black market codenamed “blue”.

How does the dollar blue work?

The blue dollar works like any other U.S. dollar bill. It can be used to purchase goods and services in Argentina or exchanged for Argentine pesos at the current exchange rate (which is usually much higher than the official exchange rate).

One thing to keep in mind is that since the blue dollar is not an official currency, it is not backed by any government or central bank. This means that there is always a risk that it could suddenly lose value if the demand for dollars decreases or if the government takes measures to repress its use.

Who uses the dollar blue?

Everyone, from large companies to ordinary people, uses the blue dollar in Argentina.

Companies use it because it allows them to avoid foreign exchange controls and gain access to capital to which they would not otherwise have access. Ordinary people use it because it allows them to conserve their savings in times of economic crisis.

In fact, many Argentines keep most or all of their savings in dollars rather than pesos because they believe it is a more stable store of value.

The blue dollar is an important part of the Argentine economy, used by everyone from large companies to ordinary people. Although it is not an official currency, it has become a popular way to preserve savings and circumvent exchange controls in Argentina.

Other types of changes also interesting for the tourist

What types of dollar rates are available in the Argentine market and what are the best options for travel? …

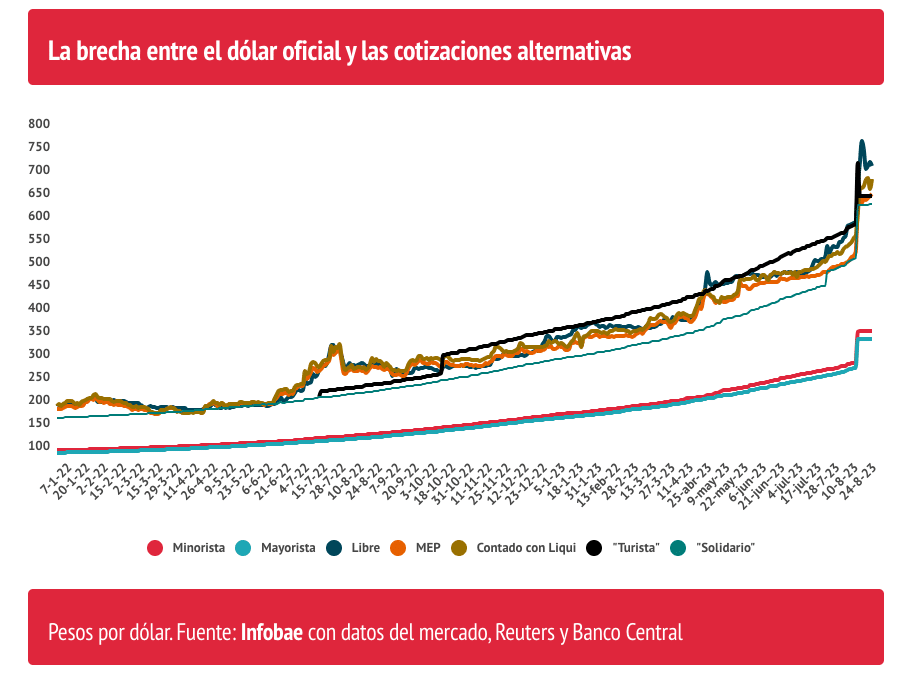

The popularity of the informal U$D market (in black, meaning undeclared money exchanges) and the widespread use of savings led to what is called the exchange rate gap: an increasingly significant distance between the official dollar (the official value of the U$D, which is only a formality at the moment) and the blue dollar and other types of parallel dollars.

And the diversification of Argentina’s economic activities to avoid this stagnation has resulted in the subdivision of the U$D exchange rates into tourist dollar, meat dollar, soybean dollar, MEP, among many others.

Other dollar rates:

- MEP DOLLAR: Also called “bag dollar” (after “stock market”), the MEP is applied in the local market. With Dollar MEP you can buy bonds and sell dollars and Argentine pesos according to the stock market price. (This type of dollar can be used for international tourism if you pay with a credit card domiciled in your country.

- DOLAR BLUE: As we have explained previously, the blue dollar is the exchange value related to the illegal or “black” market of U$D and/or Euros. Because the blue dollar is supposedly less subject to market fluctuations, the use of “blue” has expanded well beyond other exchange rates, making “blue” more popular in the first place. First, and second, it makes it much more expensive. than the official dollar.

- TOURIST DOLLAR: The tourist dollarIt is mainly aimed at Argentine travelerswho are looking to spend U$D outside their country of origin. There is a 35% increase in relation to the official dollar (which, remember, is much lower in value than the blue dollar) for credit, debit card and cash transactions from Argentines traveling abroad.

Money exchange tips in Buenos Aires, Argentina

Arbolitos y cuevas de cambio (small trees and change caves)

The arbolitos (trees) or informally called “cuevas” buy and sell dollars at the value indicated by the blue dollar exchange rate (see above). Most of the trees, in fact, almost all of them, are located in Florida, in the Microcentro. area where most offices and banks are located.

What happens in the cave stays in the cave. There is a spoken and explicit agreement between the buyer and the seller. That agreement is not on paper, but it is operational anyway, so you cannot change the price at which you are going to sell your cash dollars once you get to the arbolito. There are risks involved, so it is best to ask a local or tour guide for reliable sites.

It is best to look for a cave delivery system, about which you should ask the seller, so that the transaction can be carried out safely, either at a nearby gas station or in a hotel lobby.

Be safe at all times when carrying money back and forth. Due to Argentina’s economic instability, U.S. dollars in the country are highly valued; to avoid theft in any way, shape or form, it is best to wear a money belt under your clothes. The money belt itself should be hidden from view and covered with clothing.

Keep that in mind that exchanging dollars in a cave is an illegal transaction, so you will not get any document or guarantee for the transaction made.

My advice

Changing your dollars or euros to Argentine pesos on the street or in a cave can be a complex and unsafe process.

Although there are exchange houses in the downtown area that offer to exchange your money at the “blue” rate, this experience can be dangerous as you are exposed to people following you out of the exchange house and mugging you.

What I recommend is to exchange your money at a blue rate in the offices of Western Union, which is an official exchange house and has offices in the best neighborhoods of Buenos Aires such as Recoleta or Palermo.

View Western Union offices in Buenos Aires:

https://location.westernunion.com/ar/caba/buenos-aires

Or as I recommend at the end of this article use your credit card at a MEP exchange rate.

Change at ATMs in Argentina (ATM)

If you wish to withdraw local currency it is possible to do so at most ATMs in the city.

However, there are current restrictions on the amount you can withdraw per transaction and credit and debit cards generally limit the total amount you can withdraw per day and week.

In addition, you may be charged a fee for withdrawing money (check with your bank before traveling).

There are two types of banks in Argentina; Banelco, a red B sign, and Link, a green Link sign. All local banks have the Link sign and are cheaper for cash withdrawals than Banelco banks.

When using an ATM, do not use it to withdraw small amounts of money, as there is a minimum commission of $10 for this type of banking operations, and keep in mind that you will get the value of the official dollar.

Although there are many ATMs in the city, they can sometimes run out of cash, especially on long weekends and holidays. ATMs also have a withdrawal limit, and that will depend on your debit/credit card, your bank and the country you are from.

Basically talk to your bank and make sure that your withdrawal limit in Argentina suits your needs.

ATM in Argentina.

Use of Credit Cards (Foreign) in Argentina

To prevent tourists from having to travel with wads of cash in their pockets, something that, as mentioned above, is dangerous for tourists.

The Argentine Government implemented a system together with the 2 most important credit card providers: Visa and Mastercard so that foreign tourists can pay directly with their credit card in pesos within Argentina and an exchange rate known as MEP is applied, which only differs by approximately 8% from the BLUE exchange rate.

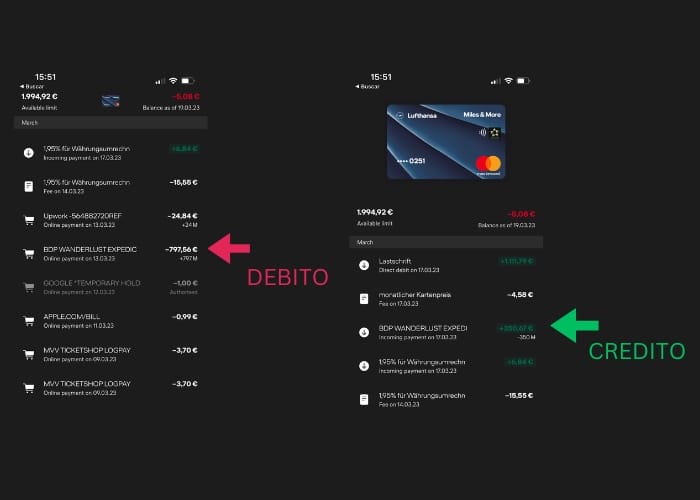

Example of chargeback and withdrawal on a german credit card

In order to better explain this option, let’s do an exercise together, as if we were at school.

Let’s suppose I want to book this excursion to the Perito Moreno Glacier Moreno Glacier which has a value of 197 dollars which would be about 35,460 pesos at today’s exchange rate on January 14, 2022.

- If I buy it online the final value in dollars is 197 USD.

- If I buy it directly in El Calafate at a local agency and pay with pesos in cash exchanged at the Blue value, the final value in dollars will be 97 USD.

- If I pay by credit card (domicile outside Argentina) and through Patagonline (Invoice in pesos), the final value in dollars will be 104 USD.

Other advantages of taking pre-contracted services through Patagonline.

- You have experts to advise you in the planning of your tailor-made route.

- You have pre-booked the most important services (flights, hotels and excursions) and avoid the stress of having to book everything on the fly.

- You avoid going with bundles of tickets when hiring a service.

- You avoid the risk of changing money in caves, which involves some danger (you only use your credit card).

Foreign Tourist Dollar

When it comes to exchanging money in Argentina, travelers often find themselves caught between the official exchange rate and the unofficial “dollar blue” rate. While the blue dollar rate may seem tempting due to its more favorable exchange rate, it’s important to consider the risks and legal implications of using the black market for currency exchange. One often-overlooked but smart option for travelers is to use a credit card to gain access to the Mercado Electrónico de Pagos (MEP) exchange rate. Here’s why this is a good idea.

Understanding the Landscape

Official Exchange Rate

The official exchange rate is the rate set by the government for exchanging pesos for foreign currency. This rate is often less favorable compared to the blue rate found in the blue market, essentially Argentina’s black market for currency exchange.

Dollar Blue

The dollar blue exists due to restrictions on acquiring foreign currency through official channels, leading to currency depreciation. While the blue rate is more favorable, it comes with its own set of risks, including legal implications.

Foreign Tourist Dollar

Some businesses offer a “tourist dollar” rate, which is more favorable than the official rate but not as good as the blue rate. This is another option for travelers but can be inconsistent.

Why Use a Credit Card for MEP Exchange?

Legal Safety

Using a credit card to access the MEP exchange rate is a legal way to get a more favorable exchange rate compared to the official rate. This eliminates the risks associated with the blue market.

Transaction Fees

While transaction fees may apply when using a credit card, they are often lower than the fees associated with services like Western Union or wire transfers to a bank account.

Credit Card Statements

Your credit card statements will provide a transparent record of all transactions, including the exchange rate applied. This is especially useful for travelers using Visa cards, as Visa is widely accepted in Argentina.

Convenience

Using a credit card eliminates the need to carry large amounts of dollar bills, making it a safer and more convenient option. It also saves you the trouble of visiting an exchange office in Buenos Aires or elsewhere.

How to Do It

- Credit Card: Use your foreign credit card to withdraw pesos from your local account, thereby accessing the MEP exchange rate.

Tips for Travelers

- Compare Rates: Always compare the MEP rate with the official rate and the foreign tourist dollar rate to ensure you’re getting the best deal.

- Be Aware of Fees: Check the transaction fees associated with your credit card and compare them to other options like Western Union.

- Exchange Pesos Wisely: If you still need to exchange pesos, do so at a reputable currency exchange office and avoid exchanging money in the blue market to stay on the right side of the law.

While the allure of the dollar blue rate may be tempting, using a credit card to access the MEP exchange rate offers a legal and often more favorable way to exchange money in Argentina. It provides a transparent, convenient, and safer alternative, making it an excellent choice for travelers navigating the complex financial landscape of Argentina.

This is where I wanted to finally get to but I could not do so without first explaining the different types of exchange and the advantages and disadvantages of exchanging cash or credit card and the different exchange rates.

From my point of view the most convenient way is to use a credit card (Mastercard and Visa) that is domiciled abroad where you will be charged an exchange rate only 8% less than Blue but that brings a lot of advantages and conveniences when traveling in Argentina.

And in case you want to organize your trip with a local travel agency, keep in mind that if you pay for the trip in pesos (with your foreign credit card) you are saving almost 50% of the travel cost.

The credit card will make the corresponding reimbursements (difference between the official exchange rate and the MEP exchange rate) automatically to your account.

If you want to contact me you can write me from here