When traveling to Argentina, the complexities of currency exchange can be daunting. Between the official exchange rate and the infamous “dollar blue” there’s another option that often goes unnoticed: the “tourist dollar Argentina” rate. This rate is designed to offer a more favorable exchange rate to tourists, and it comes with its own set of advantages and considerations.

What is the Tourist Dollar?

The tourist dollar rate is a special exchange rate offered by some businesses and currency exchange offices in Argentina. It’s more favorable than the official rate but not as lucrative as the blue dollar rate. This rate aims to attract foreign tourists by offering a better value for their foreign currency.

Why Choose the Tourist Dollar?

Legal Safety

Unlike the blue market, exchanging money at the tourist dollar rate is legal and eliminates the risks associated with black market transactions.

Convenience

The tourist dollar rate is often available at reputable currency exchange offices and even some hotels, making it a convenient option for travelers.

Credit Card Statements

When you use a credit card to make transactions at businesses offering the tourist dollar rate, your credit card statements will reflect this rate, providing a transparent record of your expenditures.

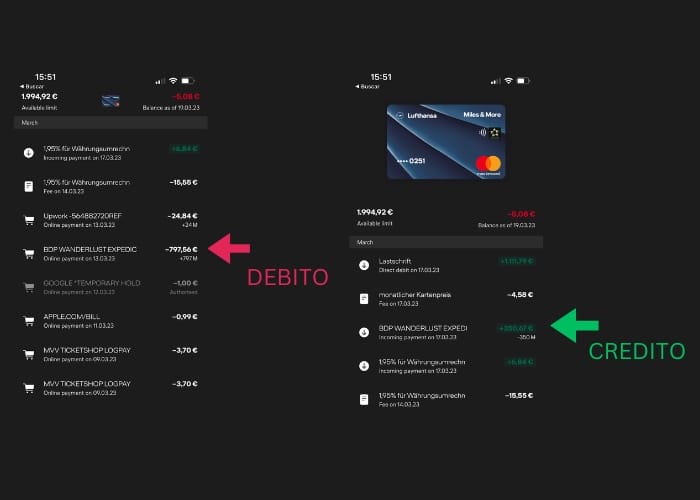

Example of chargeback and withdrawal on a german credit card

Navigating the complex world of currency exchange in Argentina can be a challenge for tourists. While options like the official exchange rate and the “dollar blue” exist, there’s a lesser-known but highly advantageous route: accessing the Mercado Electrónico de Pagos (MEP) exchange rate using a foreign credit card. This option is exclusively available for tourists with foreign credit cards and offers a host of benefits.

What is the MEP Exchange?

The MEP exchange rate is a financial mechanism that allows for a more favorable exchange rate compared to the official rate. While locals can access it through more complicated financial transactions, tourists with foreign credit cards have the unique advantage of direct access.

Why Use a Foreign Credit Card for MEP?

Legal Compliance

The MEP exchange rate is a legal method of currency exchange, eliminating the risks associated with the black market or “dollar blue” rates.

Favorable Rates

The MEP rate is often more favorable than both the official rate and the tourist dollar Argentina rate, giving you more value for your money.

Transparency

Using a foreign credit card for accessing the MEP rate ensures that all transactions are transparent and can be easily tracked through your credit card statements.

Tips for Maximizing the MEP Rate

- Transaction Fees: Always be aware of any transaction fees that may apply when using your foreign credit card. Compare these to other methods like Western Union to ensure you’re getting the best deal.

- Credit Card Acceptance: Ensure that your credit card, whether it’s a Visa or another type, is widely accepted at your travel destination in Argentina.

Conclusion

For tourists in Argentina with foreign credit cards, leveraging the MEP exchange rate offers a legal, transparent, and financially advantageous method for currency exchange. It stands as an excellent alternative to the official and tourist dollar rates, providing a smart financial strategy for maximizing your travel budget.